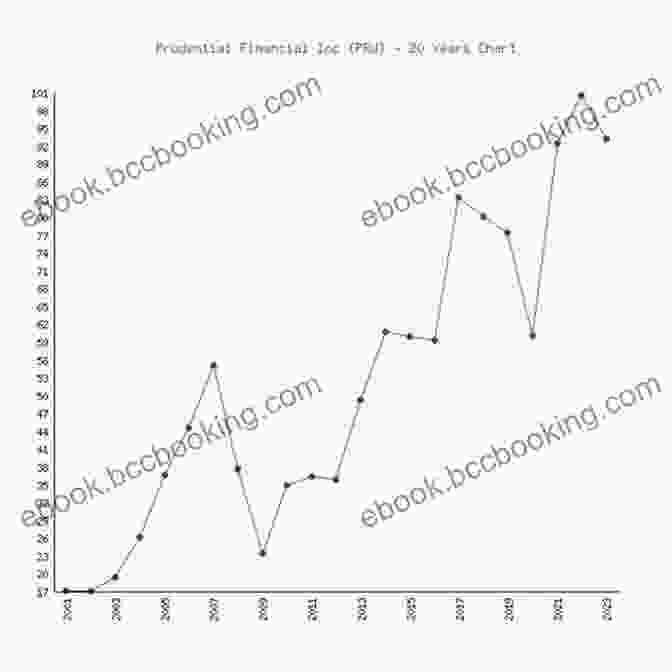

Unveiling Future Market Trends: Price Forecasting Models for Prudential Financial (PRU) Stock Amidst 500 Fortune Companies

In the ever-evolving landscape of the stock market, predicting the future performance of stocks is a highly sought-after skill. Investors, analysts, and financial institutions alike are constantly seeking ways to gain an edge in the market and maximize their returns. Price forecasting models have emerged as a powerful tool in this pursuit, providing valuable insights into the potential price movements of stocks.

This comprehensive guide delves into the world of price forecasting models, focusing specifically on their application to Prudential Financial (PRU) stock within the context of the Fortune 500 companies. We will explore the various types of models used, their underlying assumptions, and their effectiveness in predicting stock prices. Whether you're a seasoned investor or just starting out, this guide will provide you with the knowledge and tools you need to make informed investment decisions.

5 out of 5

| Language | : | English |

| File size | : | 1441 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 74 pages |

| Lending | : | Enabled |

Understanding Price Forecasting Models

Price forecasting models are mathematical or statistical models that attempt to predict the future price of a stock based on historical data and other relevant factors. These models can range from simple trend-following models to complex machine learning algorithms. The choice of model depends on the specific characteristics of the stock being analyzed, as well as the goals and risk tolerance of the investor.

There are three main types of price forecasting models:

- Technical Analysis Models: These models use historical price data to identify patterns and trends that can be used to predict future price movements. They assume that past price behavior is indicative of future behavior.

- Fundamental Analysis Models: These models consider the financial health and performance of a company, as well as external economic factors, to forecast future stock prices. They assume that a company's intrinsic value is reflected in its stock price.

- Econometric Models: These models combine elements of both technical and fundamental analysis, using statistical techniques to identify relationships between economic variables and stock prices. They assume that economic conditions can have a significant impact on stock prices.

Applying Price Forecasting Models to Prudential Financial (PRU) Stock

Prudential Financial, Inc. (PRU) is a leading financial services company that provides a wide range of products and services, including life insurance, annuities, and mutual funds. The company is ranked among the Fortune 500 companies, with a market capitalization of over $50 billion.

Given its size and significance in the financial industry, PRU stock is closely followed by investors and analysts. A number of price forecasting models have been developed to predict the future performance of PRU stock, using a variety of approaches.

One common approach is to use technical analysis models to identify trends and patterns in PRU's historical stock price data. These models can be used to make short-term predictions about the direction of the stock price. For example, a moving average model might be used to identify the average price of PRU stock over a certain period of time, and then use this information to predict future price movements.

Another approach is to use fundamental analysis models to assess the financial health and performance of Prudential Financial. These models consider factors such as the company's earnings, revenue, debt, and cash flow to determine its intrinsic value. By comparing the intrinsic value to the current market price, investors can make informed decisions about whether to buy, sell, or hold PRU stock.

Econometric models can also be used to forecast the future price of PRU stock. These models combine statistical techniques with economic data to identify relationships between economic variables and stock prices. For example, an econometric model might be used to predict the impact of interest rate changes on the price of PRU stock.

Evaluation of Price Forecasting Models

The effectiveness of a price forecasting model is typically evaluated based on its accuracy and reliability. Accuracy refers to the model's ability to predict the actual future price of a stock, while reliability refers to the model's consistency in making accurate predictions.

There are a number of statistical measures that can be used to evaluate the accuracy and reliability of price forecasting models. These measures include the mean absolute error (MAE),the root mean square error (RMSE),and the R-squared statistic.

The MAE measures the average difference between the predicted price and the actual price, while the RMSE measures the standard deviation of the differences between the predicted price and the actual price. The R-squared statistic measures the proportion of the variance in the actual price that is explained by the model.

Price forecasting models can be a valuable tool for investors seeking to make informed investment decisions. These models can help investors identify trends and patterns in stock prices, assess the financial health of companies, and predict the impact of economic factors on stock prices.

However, it is important to remember that price forecasting models are not perfect. They are based on historical data and assumptions, and they cannot guarantee future performance. Investors should always use caution when making investment decisions based on price forecasting models, and they should consider a variety of factors before making any investment.

Call to Action

If you are interested in learning more about price forecasting models and how to use them to make informed investment decisions, I encourage you to Free Download my book, "Price Forecasting Models For Prudential Financial Pru Stock 500 Companies By." This book provides a comprehensive overview of price forecasting models, including their strengths, weaknesses, and applications. It also includes a number of case studies that demonstrate how to use price forecasting models to forecast the future performance of stocks.

Free Download your copy today and start making more informed investment decisions!

Free Download Now

5 out of 5

| Language | : | English |

| File size | : | 1441 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 74 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Mark Davies

Mark Davies Mamta Nainy

Mamta Nainy Nan Sanders Pokerwinski

Nan Sanders Pokerwinski Scientia Media Group

Scientia Media Group William Cowper Prime

William Cowper Prime R W W Greene

R W W Greene Valerie Bass

Valerie Bass Michael Matthews

Michael Matthews Susan E B Schwartz

Susan E B Schwartz Sam Cowen

Sam Cowen Marianne Waggoner Day

Marianne Waggoner Day Rick Schwartz

Rick Schwartz Steve Simmons

Steve Simmons Thomas Meyer Zur Capellen

Thomas Meyer Zur Capellen Wright Thompson

Wright Thompson Samuel S Cottle

Samuel S Cottle Lynda Cheldelin Fell

Lynda Cheldelin Fell Rochelle Knight

Rochelle Knight Sasha Anawalt

Sasha Anawalt Richard Thompson Ford

Richard Thompson Ford

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Kevin Turner**Ghazghkull Thraka: Prophet of the Waaagh! Unleash the Unstoppable Power in...

Kevin Turner**Ghazghkull Thraka: Prophet of the Waaagh! Unleash the Unstoppable Power in...

Natsume SōsekiThe Great Depression: Lorena Hickok, Eleanor Roosevelt, and the Shaping of...

Natsume SōsekiThe Great Depression: Lorena Hickok, Eleanor Roosevelt, and the Shaping of... Giovanni MitchellFollow ·17.9k

Giovanni MitchellFollow ·17.9k Charles ReedFollow ·2.9k

Charles ReedFollow ·2.9k Arthur C. ClarkeFollow ·3.6k

Arthur C. ClarkeFollow ·3.6k Demetrius CarterFollow ·15.1k

Demetrius CarterFollow ·15.1k Edgar CoxFollow ·10.1k

Edgar CoxFollow ·10.1k Roland HayesFollow ·2.3k

Roland HayesFollow ·2.3k Edward ReedFollow ·8k

Edward ReedFollow ·8k Drew BellFollow ·12.1k

Drew BellFollow ·12.1k

Philip Bell

Philip BellPersonal History: From the Last Imperial Dynasty to the...

By Author Name A...

Gustavo Cox

Gustavo CoxAlexander Csoma de Kőrös: The Father of Tibetology

Alexander...

Harvey Bell

Harvey BellUnveiling the Titanicat: Dive into the True Stories...

A Literary Voyage into the...

José Martí

José MartíUnveiling the Festive Flavors of Christmas: A Culinary...

As the crisp winter air fills with the...

5 out of 5

| Language | : | English |

| File size | : | 1441 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 74 pages |

| Lending | : | Enabled |