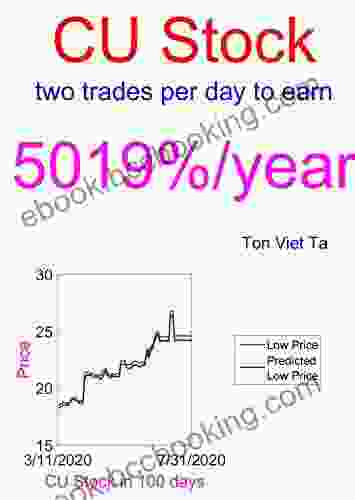

Unlock the Secrets of Copper Price Forecasting: A Comprehensive Guide to Price Forecasting Models for First Trust ISE Global Copper Index Fund (CU)

Copper, a versatile and indispensable metal, plays a pivotal role in global industries, from construction and manufacturing to electronics and renewable energy. As a result, accurately forecasting copper prices is crucial for investors seeking to capitalize on market opportunities and mitigate risks. This comprehensive guide delves into the world of price forecasting models specifically tailored for First Trust ISE Global Copper Index Fund (CU),providing invaluable insights into the factors that influence copper prices and empowering investors with the knowledge to make informed investment decisions.

5 out of 5

| Language | : | English |

| File size | : | 1543 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 56 pages |

| Lending | : | Enabled |

Understanding First Trust ISE Global Copper Index Fund (CU)

First Trust ISE Global Copper Index Fund (CU) is an exchange-traded fund (ETF) that tracks the performance of the Solactive Global Copper Index. This index comprises a diversified portfolio of companies involved in the copper industry, including mining, smelting, and refining companies. By investing in CU, investors gain exposure to the global copper market and can benefit from price fluctuations in the underlying commodity.

Factors Influencing Copper Prices

Copper prices are influenced by a complex interplay of macroeconomic, supply-side, and demand-side factors. Some key drivers include:

Economic Growth

Copper is a cyclical commodity, meaning its demand closely follows the ups and downs of the global economy. Periods of strong economic growth typically lead to increased demand for copper, driving up prices. Conversely, economic downturns can suppress demand and put downward pressure on prices.

Supply and Demand Dynamics

The balance between copper supply and demand is a fundamental determinant of prices. Supply factors, such as mine production, can impact availability, while demand factors, such as industrial activity and infrastructure development, drive consumption.

Currency Fluctuations

Copper is traded in U.S. dollars, so fluctuations in currency exchange rates can affect its price in other currencies. A stronger U.S. dollar can make copper more expensive for buyers using other currencies, potentially reducing demand.

Government Policies

Government policies, such as tariffs and subsidies, can influence the cost of copper production and consumption. Changes in these policies can have a ripple effect on prices.

Price Forecasting Models for First Trust ISE Global Copper Index Fund (CU)

Various price forecasting models can be employed to predict the future price of CU. These models leverage historical data, market trends, and economic indicators to generate forecasts. Some commonly used models include:

Time Series Models

Time series models analyze historical price data to identify patterns and trends. They assume that future prices will follow similar patterns, making them suitable for short-term forecasting.

Econometric Models

Econometric models incorporate economic variables, such as GDP and inflation, to forecast copper prices. These models are typically more complex but can provide insights into the long-term price outlook based on macroeconomic conditions.

Machine Learning Models

Machine learning models use artificial intelligence algorithms to learn from historical data and make predictions. These models can handle large datasets and can be customized to account for specific market dynamics.

Hybrid Models

Hybrid models combine elements of different forecasting methods to improve accuracy. They leverage the strengths of multiple approaches, providing a more robust forecast.

Evaluating Price Forecasting Models

When selecting a price forecasting model, it is crucial to evaluate its performance based on various metrics, such as:

Accuracy

The accuracy of a model is assessed by comparing its predictions to actual prices. Measures such as mean absolute error (MAE) and root mean square error (RMSE) are used to quantify accuracy.

Bias

Bias refers to the systematic error in a model's predictions. A model should be unbiased, meaning its predictions are neither consistently overestimating nor underestimating actual prices.

Robustness

Robust models perform well across different market conditions. They should be able to adapt to changing market dynamics and provide reliable forecasts in both bullish and bearish markets.

Using Price Forecasting Models to Inform Investment Decisions

Price forecasting models can provide valuable insights for investors looking to make informed decisions about CU. By understanding the factors influencing copper prices and leveraging reliable forecasting methods, investors can:

Identify Market Trends

Forecasting models can help investors identify emerging trends in the copper market. These trends can provide early indications of future price movements, enabling investors to position themselves accordingly.

Set Realistic Price Targets

Forecasts can serve as a benchmark for setting realistic price targets when buying or selling CU. By comparing forecasts to market prices, investors can determine if the market is overvalued or undervalued.

Manage Risk

Price forecasts can assist investors in managing risk by providing insights into potential price volatility. By anticipating price movements, investors can adjust their portfolio allocations and hedging strategies to mitigate losses.

Mastering the art of copper price forecasting is essential for investors seeking to capitalize on the opportunities presented by First Trust ISE Global Copper Index Fund (CU). This comprehensive guide has provided an in-depth understanding of the factors influencing copper prices and explored various price forecasting models tailored to CU. By leveraging these models and evaluating their performance, investors can enhance their decision-making process, identify market trends, and ultimately make informed investment decisions that align with their financial goals.

Remember, price forecasting is not an exact science, and actual prices can deviate from forecasts. However, by integrating price forecasting models into their investment strategy, investors can increase their chances of success in the dynamic and ever-evolving copper market.

5 out of 5

| Language | : | English |

| File size | : | 1543 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 56 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Margot Adler

Margot Adler Victoria Steele

Victoria Steele Julia E Clements

Julia E Clements Sherry Simpson

Sherry Simpson Roanne Van Voorst

Roanne Van Voorst Madelynne Diness Sheehan

Madelynne Diness Sheehan Laura Shapiro

Laura Shapiro Richard Yamarone

Richard Yamarone Srini Sekaran

Srini Sekaran Mel Martinez

Mel Martinez Terry Ann Williams Richard

Terry Ann Williams Richard Marjory Stoneman Douglas

Marjory Stoneman Douglas Peter Vacher

Peter Vacher Victor Silvester

Victor Silvester Stephan Martin

Stephan Martin Kin F Kam

Kin F Kam Meaghan Wilson Anastasios

Meaghan Wilson Anastasios Mario Beauregard

Mario Beauregard Tony Barnhart

Tony Barnhart Tom Rubython

Tom Rubython

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Felix CarterScientific Approach to Writing for Engineers and Scientists: A Comprehensive...

Felix CarterScientific Approach to Writing for Engineers and Scientists: A Comprehensive... John Dos PassosFollow ·15.2k

John Dos PassosFollow ·15.2k Dallas TurnerFollow ·19.9k

Dallas TurnerFollow ·19.9k Blake BellFollow ·15.7k

Blake BellFollow ·15.7k Roland HayesFollow ·2.3k

Roland HayesFollow ·2.3k Sidney CoxFollow ·9.4k

Sidney CoxFollow ·9.4k Felipe BlairFollow ·15k

Felipe BlairFollow ·15k Joe SimmonsFollow ·10.7k

Joe SimmonsFollow ·10.7k Wayne CarterFollow ·14k

Wayne CarterFollow ·14k

Philip Bell

Philip BellPersonal History: From the Last Imperial Dynasty to the...

By Author Name A...

Gustavo Cox

Gustavo CoxAlexander Csoma de Kőrös: The Father of Tibetology

Alexander...

Harvey Bell

Harvey BellUnveiling the Titanicat: Dive into the True Stories...

A Literary Voyage into the...

José Martí

José MartíUnveiling the Festive Flavors of Christmas: A Culinary...

As the crisp winter air fills with the...

5 out of 5

| Language | : | English |

| File size | : | 1543 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 56 pages |

| Lending | : | Enabled |